The company will then add the issuer fee, which is usually 2%. The network fee is charged by the credit card company itself, because it facilitates the currency conversion. One is the currency conversion fee (also called a “network fee”), and the other is an issuer fee. Though the foreign transaction fee on credit cards will be disclosed as a single percentage, usually 3%, it comprises two separate fees. What does a foreign transaction fee consist of? When you make a purchase involving a foreign currency, the credit card company will add the foreign transaction fee to the cost of your purchases. The foreign transaction fee will be stated in the credit card company’s “ Terms and Conditions” disclosure, which will be available to you when you apply for the card. This avoids the complications and fluctuations that can come from converting different foreign currencies using different agencies and institutions. It sets a single, flat fee consumers pay on purchase activity involving currency conversions. The alternative, widely employed by credit card companies, is a foreign transaction fee. It’s paid to the agency or organization that is facilitating the conversion. Typical cross-border transactions involve a conversion fee, which is the cost to convert one currency into another. Here’s why: Whenever one currency is converted into another, there are costs. This can even happen when you’re making online purchases from an individual or a business located in a foreign country. If the transaction takes place in a country or financial institution that normally uses a currency other than dollars, fees will be involved. When a transaction involves a foreign bank.When you make purchases in a foreign currency.

How do foreign transaction fees work?įoreign transaction fees can be incurred primarily in one of two situations: First, a little more about the fees themselves. Still, just because many credit cards charge foreign transaction fees doesn’t mean you have to pay them. There are fees associated with that transaction. dollars need to be converted to the local currency.

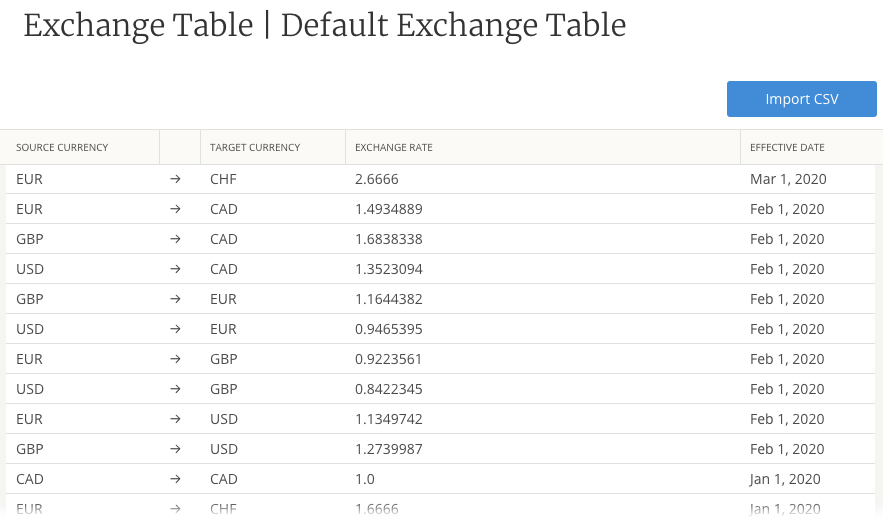

Here’s why: When you make a purchase in a foreign country, U.S. If you want to check the bank's historical exchange rate information, please go to "Inquiry for Historical Foreign Exchange Rate".When you travel to a foreign country and charge expenditures in a currency other than dollars, it’s likely your credit card will charge you a foreign transaction fee.

#Chase bank foreign exchange rate upgrade#

This webpage card informs exchange rate information shows for the static behavior, the card shown informs exchange rate information will not continue unusual fluctuation and upgrade information automatically afterwards, want to learn new brand of our bank the most please press ' obtain the newest quotation ' the button to inform exchange rate information.Real prices at the banking counter are according to our quote prices at that time in transaction.Real prices in net bank are according to the display prices at that time in transaction.The Information provided here is only for your reference, and does not represent any real price in transactions.

0 kommentar(er)

0 kommentar(er)